Porter's Five Forces Model: Definition and Examples

You will agree with me that any organisation – whether big or small – face a multitude of challenges and uncertainties in the dynamic business environment.

To navigate this complex landscape successfully, it is essential to develop a robust understanding of the competitive forces at play within an industry.

One highly regarded framework that aids in this analysis is Porter’s Five Forces Model.

Developed by renowned strategist Michael E. Porter, the Five Forces Model provides a structured approach for assessing the competitive dynamics within an industry.

This article delves into the fundamental aspects of Porter’s Five Forces Model, offering a clear definition and outlining practical examples to illustrate its relevance in today’s competitive contemporary business landscape.

Through an in-depth exploration of each force and its impact on industry competitiveness, you will gain a deeper understanding of the strategic insights this model can provide.

What is Porter's Five Forces Model?

Porter’s Five Forces model is a framework developed by Michael Porter, a renowned economist and professor at Harvard Business School.

One way to analyze your competition – and understand your standing in your industry – is using Porter’s Five Forces model.

The model is used to analyze the competitive dynamics of an industry and understand its attractiveness and profitability. It helps identify the key factors that shape an industry’s competitive environment.

By comprehensively evaluating five key factors, businesses can gain valuable insights into their industry’s attractiveness and competitive positioning. This framework has evolved into a crucial instrument for making strategic decisions, empowering organizations to recognize opportunities, minimize risks, and develop influential business strategies.

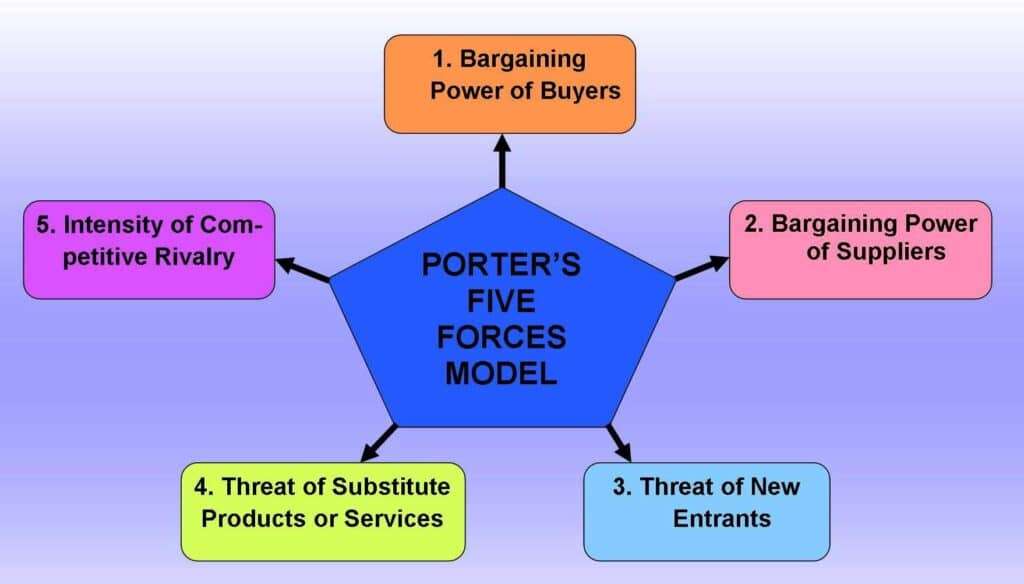

From analyzing the bargaining power of buyers and suppliers to understanding the threat of new entrants and substitute products, Porter’s Five Forces Model offers a comprehensive framework that uncovers the key drivers shaping an industry’s competitive dynamics.

Additionally, the model helps identify the intensity of competitive rivalry within an industry, shedding light on the factors that influence market positioning, pricing strategies, and the overall profitability of businesses.

Understanding Porter's Five Forces:

Porter‘s Five Forces Model offers a structured framework for assessing the attractiveness and profitability of an industry and assists businesses in formulating effective strategies to navigate the competitive landscape.

Following is a comprehensive evaluation of the five key forces to help you gain valuable insights into your industry’s dynamics and make informed decisions.

1. Bargaining Power of Buyers

The first force in Porter’s model focuses on the power exerted by buyers/customers in the market.

This force examines the extent to which buyers can influence prices, demand better quality or service, or switch to alternative products or suppliers.

Factors such as concentration of buyers, price sensitivity, and availability of substitutes play a crucial role in determining buyer power.

Example: In the airline industry, individual travelers typically have limited bargaining power due to the relatively high costs associated with switching airlines.

However, large corporations or travel agencies that purchase tickets in bulk may possess significant bargaining power, allowing them to negotiate discounted fares or better service terms.

2. Bargaining Power of Suppliers

The second force examines the influence of suppliers on an industry.

It assesses the suppliers’ ability to raise prices, limit supply, or exert control over critical inputs.

Industries heavily reliant on unique or specialized inputs, or those with a limited number of suppliers, often face higher supplier power.

Example: The automobile manufacturing industry relies on various suppliers for components such as engines, tires, and electronics.

If there are only a few suppliers capable of providing these critical parts, they may have stronger bargaining power, enabling them to dictate prices, delivery schedules, or product specifications to the manufacturers.

3. Threat of New Entrants

This force examines the ease or difficulty of new companies entering an industry.

Industries with high barriers to entry, such as significant capital requirements, regulatory hurdles, or strong brand loyalty, are less susceptible to new entrants.

On the other hand, industries with low barriers are more prone to competitive disruption.

Example: The pharmaceutical industry often poses substantial barriers to entry due to the stringent regulatory requirements and extensive research and development costs involved.

This limits the threat of new entrants, as companies must navigate complex regulatory frameworks and make significant investments in research and testing.

4. Threat of Substitute Products or Services

The fourth force considers the availability of alternative products or services that can satisfy the same customer needs.

The presence of close substitutes can limit the pricing power and profitability of existing industry players.

Example: The traditional taxi industry faced a significant threat from ride-sharing services such as Uber and Lyft.

These services provided convenient and often more affordable alternatives to traditional taxis, causing a shift in consumer preferences and impacting the profitability of the taxi industry.

5. Intensity of Competitive Rivalry

The final force assesses the level of competition among existing players in an industry.

Factors such as the number and size of competitors, industry growth rate, and product differentiation influence competitive rivalry.

Example: The smartphone industry is highly competitive, with multiple major players vying for market share.

Intense competition leads to frequent product launches, price wars, and continuous innovation, driving companies to differentiate themselves and strive for a competitive edge.

By analyzing each of these five forces, businesses can identify opportunities, assess risks, and develop effective strategies to enhance their competitive advantage within the industry.

What Are Some Advantages and Disadvantages of Porter's Five Forces Model?

Advantages of Porter's Five Forces Model

The practical applications of Porter’s Five Forces Model are numerous. Some key applications include:

Comprehensive Analysis

The model offers a systematic and holistic approach to analyzing the competitive dynamics within an industry.

By evaluating five key forces, it provides a comprehensive view of the industry’s attractiveness and competitive landscape.

Strategic Insights

The model helps organizations gain valuable insights into the key factors shaping industry competition, such as buyer power, supplier power, threat of substitutes, and competitive rivalry.

This information enables businesses to make informed strategic decisions and develop effective strategies to navigate the industry successfully.

Industry Assessment

Porter’s model allows organizations to assess the overall attractiveness of an industry.

By understanding the forces at play, businesses can determine the potential profitability, growth prospects, and risks associated with entering or operating in a specific industry.

Identification of Opportunities and Threats

The model helps identify opportunities for growth, market positioning, and differentiation.

It also highlights potential threats, allowing organizations to proactively address challenges and mitigate risks.

Common Language and Framework

Porter’s Five Forces Model has become a widely recognized and used framework in the business world.

It provides a common language and framework for discussing and analyzing industry dynamics, facilitating communication and collaboration within organizations and across industries.

Pricing and Negotiation

Organizations can utilize the model to understand the power dynamics between suppliers, buyers, and competitors, informing pricing strategies and negotiation tactics.

Disadvantages of Porter's Five Forces Model

While Porter’s Five Forces Model is a widely recognized and influential framework, it is essential to acknowledge its limitations:

Static Analysis

One limitation of the model is that it provides a snapshot of industry dynamics at a specific point in time. It does not account for the dynamic nature of markets and the potential for rapid changes in industry forces due to technological advancements, regulatory shifts, or other external factors.

Limited Scope

The model primarily focuses on the external factors influencing an industry, such as competitive forces and industry structure. It may not adequately capture internal factors, such as a company’s unique capabilities, resources, and strategic positioning, which can also significantly impact its competitive advantage.

Lack of Quantification

The model is primarily qualitative and subjective, relying on qualitative assessments of the forces at play. It does not provide a quantitative framework for measuring the intensity or impact of each force, which can limit the precision of the analysis.

Overlooking Interdependencies

The model treats each force independently, assuming that the forces act in isolation. However, in reality, these forces often interact and influence each other. Ignoring the interdependencies among forces may lead to an incomplete understanding of industry dynamics.

Limited Predictive Power

While the model provides a valuable framework for assessing the current state of an industry, it may have limited predictive power in anticipating future changes or disruptions. Factors such as disruptive technologies or shifting consumer preferences can significantly alter industry dynamics, and the model may not capture these emerging trends effectively.

Despite these limitations, Porter’s Five Forces Model remains a widely used and respected framework for industry analysis.

Wrapping Up

We have explored the fundamental aspects of Porter’s Five Forces Model and its significance in analyzing competitive forces within industries.

Just to summarize and reiterate the key points we covered, we have learnt that Porter’s Five Forces Model has been a cornerstone in strategic analysis for several decades.

It has aided organizations understand the competitive landscape, identify opportunities, and make informed decisions.

By systematically evaluating the five forces, businesses can gain valuable insights into industry attractiveness and dynamics, empowering them to develop robust strategies and maintain a competitive edge.

The model consists of five interrelated forces that shape an industry’s structure and determine its level of competition:

Threat of New Entrants: Assessing the barriers to entry and potential entry of new competitors into the industry.

Bargaining Power of Suppliers: Evaluating the influence suppliers have over an industry and their ability to raise prices or restrict supply.

Bargaining Power of Buyers: Analyzing the power exerted by customers in negotiating prices, demanding quality, or seeking alternative products.

Threat of Substitute Products or Services: Identifying the likelihood of customers switching to alternatives or substitutes, which can impact industry profitability.

Intensity of Competitive Rivalry: Examining the degree of competition among existing industry players and the strategies they employ.

However, it is crucial to complement this model with other analytical tools and adapt its application to suit the unique characteristics of each industry.

Do you use Porter’s Five Forces Model as a way to understand your standing in your industry? Let’s know in the comments below.